Governance

We strive to improve the efficiency of management, including speedier decision-making, while ensuring the transparency, soundness, and fairness of management, thereby responding to the expectations and trust of our stakeholders.

Corporate Governance

We, SEKISUI KASEI, practice “Zen-in Keiei” based on respect for people and mutual trust. We are always innovating in our aim of “new happiness.” Based on this management philosophy, one of our materiality issues is to ensure the effective functioning of corporate governance, to ensure the transparency and soundness of management, and to establish a system that can respond quickly to changes in the business environment.

Compliance

We define compliance as not only complying with laws and regulations but also ensuring the appropriateness of operations within SEKISUI KASEI Group by adhering to various internal rules and regulations. Additionally, we believe in acting with integrity based on the values, personal ethics, and corporate ethics required by society. Our "Compliance Policy" outlines how we should act as corporate citizens, promoting good relations with society.

To strengthen and promote compliance across the Group, we have established the "Compliance and Risk Management Committee," which maintains a system to ensure legal compliance. The committee meets in principle every six months to discuss compliance issues within SEKISUI KASEI Group and reports necessary matters to the Executive Committee.

Furthermore, group companies, depending on their size, have also established "Compliance Committees" and appointed compliance officers to ensure coordination within the Group.

Risk Management

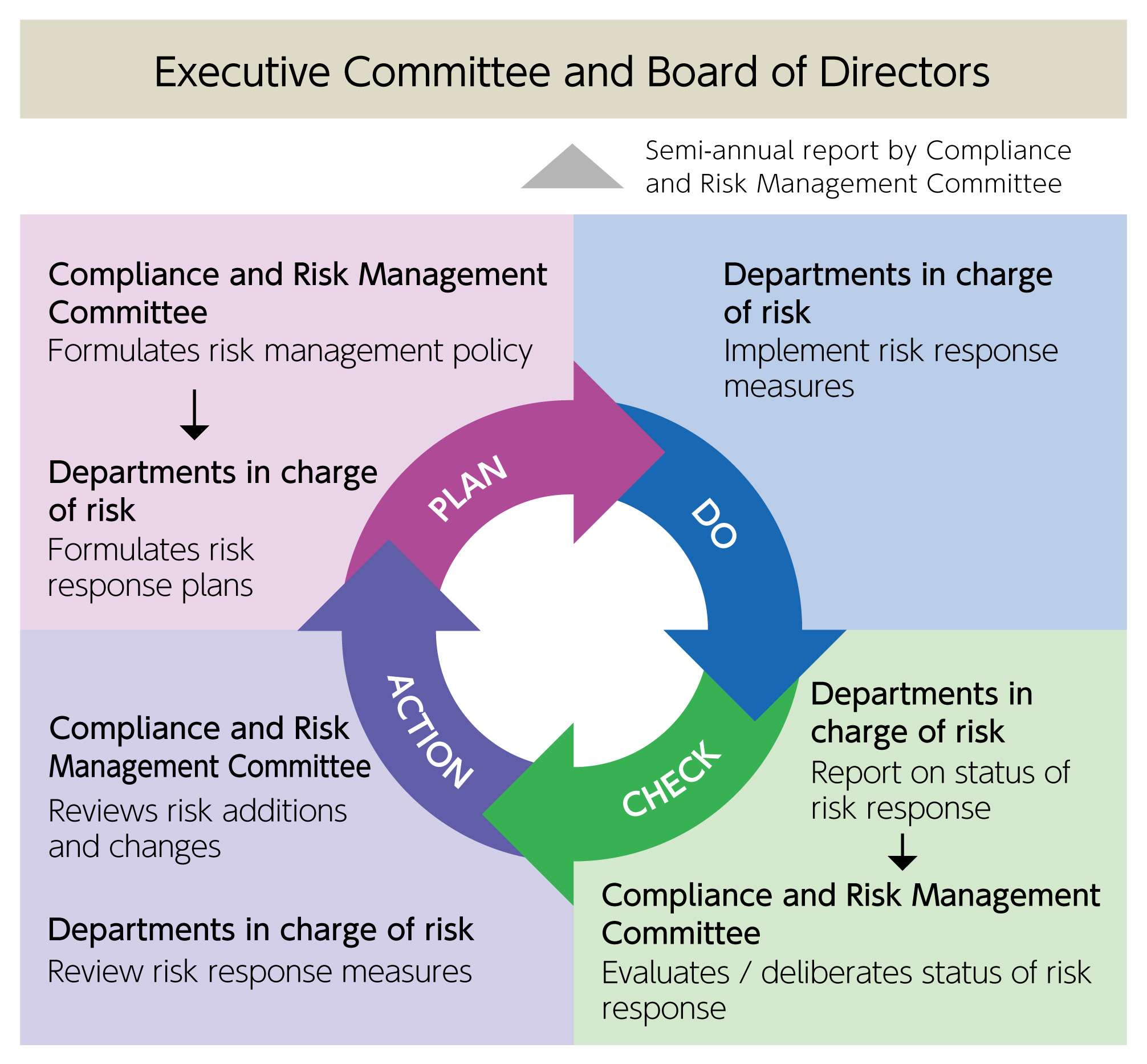

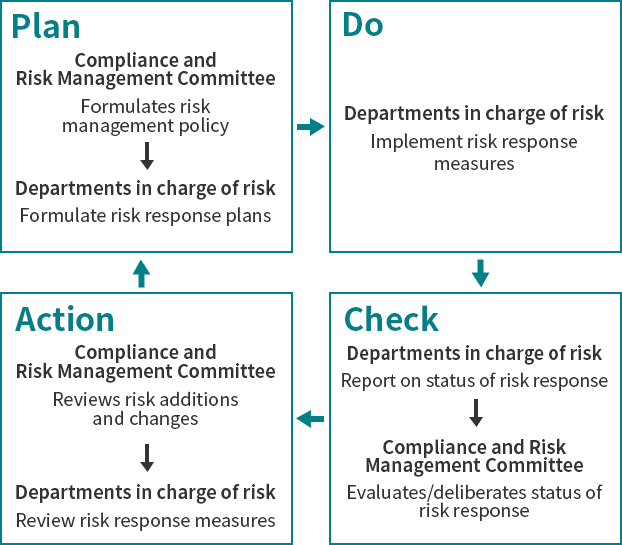

In SEKISUI KASEI Group, under the basic policy on risk management formulated by the Compliance and Risk Management Committee, which manages all risks, the departments in charge of each risk formulate response plans and take specific countermeasures.

Additionally, the Compliance and Risk Management Committee considers ESG risks (such as environmental management, safety assurance, and fraud-related risks) and creates a matrix of currently assumed risks according to their degree of severity. The committee evaluates and deliberates on the response status based on reports from the departments in charge of each risk. Based on the results of these evaluations and deliberations, the committee reviews and revises the risk response measures, thereby repeating the PDCA cycle.

Furthermore, the management status of each risk is regularly reported to and shared with the Board of Directors and the Executive Committee, which also oversee the effectiveness of the risk management process.